The April 2024 Bitcoin Halving: A Recap

April 2024 Bitcoin Halving highly anticipated the event, marking a significant milestone in the cryptocurrency world. Bitcoin Halving occurs around every four years, reducing the block reward for miners by half. This is designed to control the supply of new bitcoin entering the market and maintain its halving.

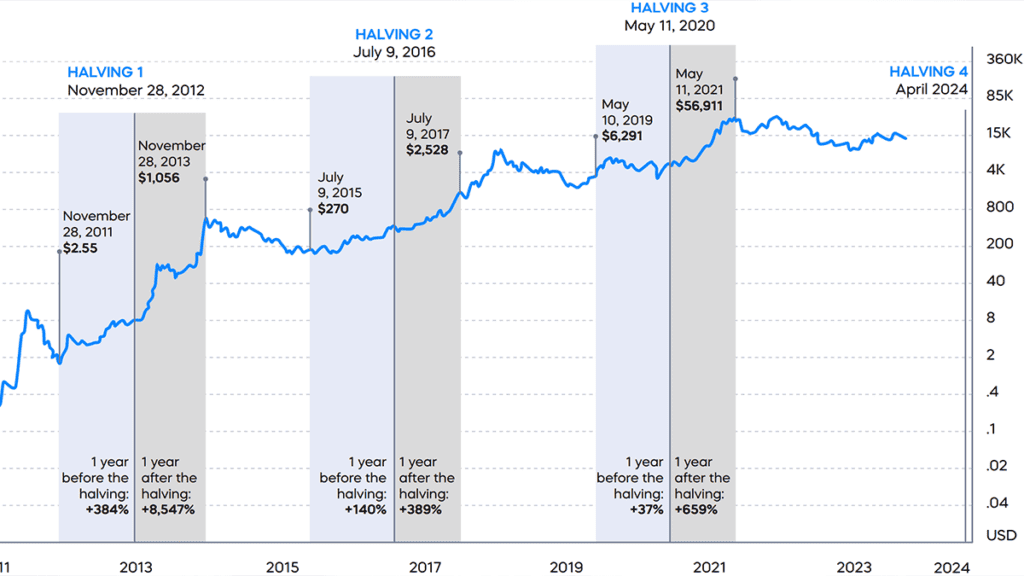

The crypto community showed great interest in the April 2024 halving. As the blockchain reward decreased to half, the rate of new bitcoins fell, potentially creating an imbalance between supply and demand. The previous Bitcoin halving event triggered price increases, and many investors eagerly anticipated its impact on the blockchain market.

After the halving, the market experienced an increase in volatility as traders and investors reacted to the reduction of block rewards. Bitcoin price already surpasses the previous event. However, it is essential to know that market conditions can be unpredictable, and past performance does not indicate future results.

The halving has also highlighted the growing institutional engagement in the Bitcoin market, with its new spot Bitcoin exchange-traded funds attracting a new generation of investors to the asset. Additionally, the environmental concerns related to Bitcoin mining, particularly in energy resources.

Impact of the Halving on Bitcoin Miners

The bitcoin halving every four years creates an unexpected situation for miners. While securing the long-term value of Bitcoin by limiting the creation of a new coin, it also cuts the block rewards in half. It directly impacted the income of their bottom line, potentially forcing some operations to shut down.

In the previous years, in 2009, miners received 50 bitcoin, followed by a reduction to 25 in 2012. It was reduced to 12.5 bitcoins in 2016; in 2020, it was reduced to 6.25. As of April 2024, it has been reduced to 3.125 bitcoin, which might need more to support operational costs for everyone.

The financial grasp can lead to consolidation in the mining industry. Some smaller bitcoin miners, unable to adapt to the lower margins, might be forced to shut down or get by the more significant players. To survive, smaller bitcoin miners need to become more efficient and strategic. This could involve finding cheaper electricity sources, looking for a new location, or upgrading to more efficient Bitcoin mining equipment.

While the halving event is challenging for the Bitcoin miners in the short term, it also strengthens the foundation of Bitcoin by controlling the supply and increasing its long-term value. It pushes the smaller Bitcoin miners to adapt and innovate.

Price predictions: Did Bitcoin Surge after the 2024 Halving?

The interesting Bitcoin halving event of April 2024 came and went, leaving some investors wondering where the price surge was. Meanwhile, past trends suggest that price increases follow a halving. Some analysts warn blockchain miners that it will be different this time.

Unlike the previous halvings, the price change in 2024 can take some time. Future price hikes between six and eighteen months following the halving are predicted by some analysts. Some factors, like the continuously expanding size of the Bitcoin industry, are the reason for this delay. As market capitalization increased, the effect decreased and the quantity of new coins decreased significantly.

Bitcoin halving and price impact

| Aspect | Impact |

| Blockchain Rewards | Reduced by half every four years. |

| New Coin Supply | It is decreasing every halving event. |

| Short-term Price Impact | It was undetermined and was delayed due to the surge. |

Even if there is no immediate price increase, another may be in the future. The halving restricts the number of new bitcoins that enter circulation, theoretically increasing scarcity. It is combined with ongoing demand, which could lead to a steady price increase in the months after the event.

For investors looking to make a fortune, patience is essential. This table shows that major price changes are more likely to occur between 8 and 16 months after the halving. In this post-halving environment, people are taking longer to alter their expectations and embrace the long term.

Long-term Implications: How will the Halving affect Bitcoin’s Future?

The bitcoin halving 2024, if focused on reducing miner rewards, throws a long shadow on cryptocurrency’s future. While no immediate price increases have been observed, the event puts into action many critical trends.

Scarcity Drives Value: The main idea of halving is to limit the generation of new coins, to increase the value of Bitcoin through scarcity. This might drive up prices in the long run, benefitting investors who remain on their bitcoin.

Miner Demands: The revenue of miners is affected by the halving of blockchain rewards and certain minor players in the market may require assistance. The current miners will adjust and concentrate on cutting costs to survive.

Greener Path: The halving event could speed up the transition to a more sustainable future. Reduced profit margins may motivate miners to engage in more environmentally friendly behavior, potentially cutting Bitcoin’s energy use.

Ecosystem Expansion: Historically, rising interest in Bitcoin has resulted in halving events. Bitcoin exchange-traded funds (ETFs) may gain traction by recruiting a new generation of investors to the ecosystem.

Bitcoin halving 2024 vs. previous halvings: a comparison

While the 2024 Bitcoin halving was significant, how does it compare to previous halvings? The following are the differences between the Bitcoin halving of 2024 and the past halvings:

| Aspect | 2024 Halving | Previous Halvings |

| Market Maturity | More global recognition in the crypto market | A less developed crypto market. |

| Increased the institutional | Adaptation of Bitcoin | Less adaption on the earlier halving events |

| Short-term Price Impact | It was undetermined and was delayed due to the surge | Previous halvings events show price increases, but the timing can be different. |

Although the 2024 bitcoin halving is unlikely to match the previous price rise, it does lay the path for future scarcity. The impacts of Bitcoin’s value become clear over time as the market matures and interest grows. The impending halving of Bitcoin in 2028 will be another momentous occasion for consumers. The Bitcoin Halving should act as a reminder to investors and miners of the cryptocurrency’s basic building blocks as well as its future development prospects as it grows and evolves.

Alex Turner started their career in finance, specializing in digital currencies and blockchain technology. With a background in economics and a passion for technological innovation, Alex became fascinated with the potential of cryptocurrencies to revolutionize global finance.